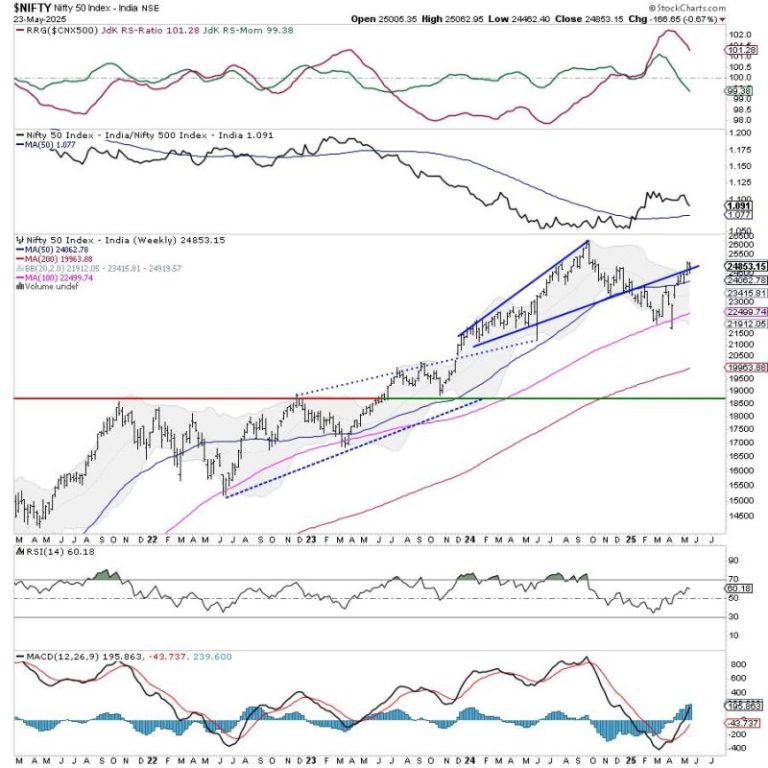

After a very strong move in the week before this one, the markets chose to take a breather. They moved in a wide range but ended the week on a mildly negative note after rebounding from their low point of the week. While defending the key levels, the markets largely chose to stay within a defined range. The trading range remained reasonably wide; the Nifty oscillated in a 600.55-point range over the past five sessions. The volatility inched modestly higher; the India Vix rose 4.40% to 17.28 on a weekly basis. While keeping its head above crucial levels, the headline index closed with a net weekly loss of 166.65 points (-0.67). The coming week will be an expiry week; we will have monthly derivatives expiry playing out as well. Going by the options data, the Nifty has created a trading range between 25100 and 24500 levels. The markets are likely…

The once-solid relationship between President Donald Trump and Apple CEO Tim Cook is breaking down over the idea of a U.S.-made iPhone. Last week, Trump said he “had a little problem with Tim Cook,” and on Friday, he threatened to slap a 25% tariff on iPhones in a social media post. Trump is upset with Apple’s plan to source the majority of iPhones sold in the U.S. from its factory partners in India, instead of China. Cook confirmed this plan earlier this month during earnings discussions. Trump wants Apple to build iPhones for the U.S. market in the U.S. and has continued to pressure the company and Cook. “I have long ago informed Tim Cook of Apple that I expect their iPhone’s that will be sold in the United States of America will be manufactured and built in the United States, not India, or anyplace else,” Trump posted on Truth…

Josef Schachter of the Schachter Energy Report shares his updated outlook for oil and natural gas. He sees a buy window potentially opening for stocks in June, and also believes oil prices are due to rise. Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article. This post appeared first on investingnews.com

It was a slow start to the week for gold, but it didn’t take long for the price to pick up. The yellow metal began the period at the US$3,220 per ounce level, but was gaining steam by Tuesday (May 20), briefly breaking US$3,300. Gold continued higher the next day, and after pulling back briefly on Thursday (May 22) was able to finish the week strong, changing hands at the US$3,360 level. Bond market turmoil is one factor that’s been influencing gold’s price movements. A Wednesday (May 21) auction of 20-year bonds was poorly received, with yields surging past 5.1 percent to reach the highest level seen since November 2023. Yields for 10-year and 30-year bonds were also on the rise, with the latter nearing a two-decade high as stocks and the dollar took hits. The upheaval in bonds came on the back of US President Donald Trump’s efforts to…

After 19 months of pounding Gaza, Israel is now under growing pressure from unlikely quarters – some of its closest Western allies. Their patience has worn thin over Israel’s decision to expand the war and, in the words of one Israeli minister, “conquer” the territory – a move paired with plans to forcibly displace Gaza’s entire population to the south and block all humanitarian aid for 11 weeks. The United Kingdom has paused trade talks and sanctioned extremist settlers in the West Bank. Canada and France have threatened sanctions. And the European Union – Israel’s biggest trade partner – is reviewing its landmark Association Agreement with the country. Aid groups have warned that the situation in Gaza is becoming catastrophic, with the United Nations’ humanitarian chief Tom Fletcher last week calling on the world to “act decisively to prevent genocide.” Dozens of babies have died of malnutrition, according to Gaza’s…

The local French authority forthe Alpes-Maritimes region said on Saturday that part of thearea was suffering a major electricity outage, including thetown of Cannes which is currently hosting its annual filmfestival. This is a developing story and will be updated. This post appeared first on cnn.com

It scares me to admit I’ve been investing for over 50 years. It’s been a great ride, and fortunately I’m still going strong. One of my investment mantras thru all these years has been Charlie Munger’s quintessential advice: “try to be consistently not stupid.” We all make investing mistakes, but not all of us learn the appropriate lessons from those mistakes. This blog is less about mistakes and more about lessons. If the investment genie were to offer me a redo on my portfolio management execution from these past decades, here are seven things I would do differently next time around. More USA, less international. I know what you’re thinking—what about diversification? But I believe that William O’Neil had it right all along. American ingenuity is where you want to invest. Besides, great American companies do business all over the globe. Microsoft is doing your diversification for you. Hot money…

This week, while everyone else is focused on NVIDIA Corp. (NVDA), we will focus our attention on stocks with earnings that may get overlooked. We’re watching a different group of stocks heading into earnings: Okta, Inc. (OKTA), AutoZone, Inc. (AZO), and Salesforce.com, Inc. (CRM). OKTA and AZO are making new highs as they head into their earnings call, while CRM is struggling. Let’s break down the best risk/reward set-ups as we kick off the week. Okta, Inc. (OKTA): Volatility Now, Potential Later Okta’s stock price broke out to new 52-week highs a week before it posts its quarterly numbers. The cybersecurity company has experienced extreme volatility after posting earnings. In the last three quarters, the stock saw some pretty big swings—up 24.3%, up 5.4%, and down 17.6%. Its average price change post-earnings is +/-10.2%. Technically, I love this setup. Let’s look at a five-year daily chart. Shares have broken out…

United Airlines reached an “industry-leading” tentative labor deal for its 28,000 flight attendants, their union said Friday. The deal includes “40% of total economic improvements” in the first year and retroactive pay, a signing bonus, and quality of life improvements, like better scheduling and on-call time, the Association of Flight Attendants-CWA said. The union did not provide further details about the deal. United flight attendants have not had a raise since 2020. The cabin crew members voted last year to authorize the union to strike if a deal wasn’t reached. They had also sought federal mediation in negotiations. U.S. flight attendants have pushed for wage increases for years after pilots and other work groups secured new labor deals in the wake of the pandemic. United is the last of the major U.S. carriers to get a deal done with its flight attendants. The deal must still face a vote by…

President Donald Trump on Friday cleared the merger of U.S. Steel and Nippon Steel, after the Japanese steelmaker’s previous bid to acquire its U.S. rival had been blocked on national security grounds. “This will be a planned partnership between United States Steel and Nippon Steel, which will create at least 70,000 jobs, and add $14 Billion Dollars to the U.S. Economy,” Trump said in a post on his social media platform Truth Social. U.S. Steel’s headquarters will remain in Pittsburgh and the bulk of the investment will take place over the next 14 months, the president said. U.S. Steel shares surged more than 20% to close at $52.01 per share after Trump’s announcement. Pennsylvania Gov. Josh Shapiro applauded the agreement, saying he worked with local, state and federal leaders ‘to press for the best deal to keep U.S. Steel headquartered in Pittsburgh, protect union jobs, and secure the future of…